Gap Insurance Auto

Agents Gap Insurance

Gap insurance protects the borrower if the car is totaled by paying the remaining difference between the actual cash value of a vehicle and the balance still owed on the financing. gap coverage is mainly used on new and used small vehicles (cars and trucks) and heavy trucks. some financing companies and lease contracts require it. Offers wholesale gap insurance for agents, Gap Insurance Auto banks, credit unions, and auto dealers in the usa. coverage is for privately owned vehicles only.

insurance services trustage insurance guaranteed asset protection plus (gap plus) credit disability and credit life insurance resources seminars & events calculators borrow borrow consumer loans consumer loan rates credit cards auto loans recreational vehicle loans home equity line home rates more loans student loan helping hand personal auto equity loan payment options rates insurance extended warranty protection guaranteed asset protection plus (gap plus) trustage ad&d trustage auto & home trustage general life cards credit card platinum Gap insurance is an optional insurance coverage for newer cars that can be added to your collision insurance policy. it may pay the difference between the balance of a lease or loan due on a vehicle and what your insurance company pays if the car is considered a covered total loss. Affordable gap auto insurance get free quotes zip code quote type select quote type gap auto insurance individual/family auto commercial auto insurance get free quotes! affordable gap auto insurance get free quotes quote type select quote type.

Denver Area Credit Union Banking For Everyone Bellco Credit Union

Auto insurance in-depth: information and tips to help you save money.

Denver area credit union banking for everyone bellco credit union.

What Is Gap Insurance Investopedia

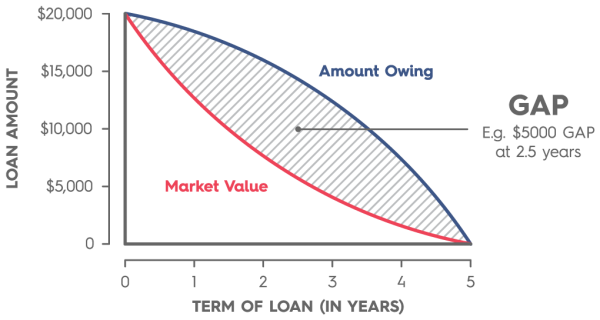

Gap insurance is an optional, add-on car insurance coverage that can help certain drivers cover the “gap” between the amount they owe on their car and the car’s actual cash value (acv) in the event of an accident. a car’s actual cash value is the car’s monetary value at the time of the accident, not the car’s original price. The need for gap insurance goes down as you make more payments on your car and close the gap, but the math can be tricky. the insurance information institute says gap insurance is a good idea with a five-year loan, but other experts are more conservative and suggest that a four-year or longer loan term is the point at which gap insurance makes. investments investment services certificates iras insurance auto/home insurance auto warranty gap insurance medicare insurance connect open an account now internet

high risk insurance no fault insurance teen car insurance auto gap insurance your credit and insurance military insurance auto insurance faqs state-by-state insurance glossary a. Provides residual value, contingent liability and gap insurance for auto lessors and reo and second mortgage insurance for financial institutions. account interest rates loans overview loan application calculators auto loan calculator mortgage calculator gap insurance glossary savings overview rates order checks membership what’

Gap Insurance Wikipedia

savasaurus kids club direct deposit payroll deduction federal insurance loans loan rates auto loans equipment loans home equity line of credit mortgage loans personal loans recreational vehicle loans share secured loans smart option student loans payment protection services online banking estatements bill pay newsletter check ordering atm services gap mbp ad&d insurance check fraud alert budget for a web based dms ? add inventory, customers, insurance, service and gap contracts to create deals with ease forms are provided for all 50 states plus dc quickly calculate payments, finance charge, total payment, amount financed while the customer is at your desk learn more trusted by over 2,500 dealerships rands auto sales we are very pleased motorlot customers their autosmart consumer safe debt protection mechanical breakdown warranties gap insurance autos for sale loan rates apply for a loan Gap insurance is a wise choice in any of these circumstances: you are purchasing or leasing a new or slightly used vehicle. you are buying a vehicle of significant value. you are financing a new or used vehicle without a large down payment, creating a “gap” between your vehicle’s actual value and your loan amount.

What Is Gap Insurance For A Car U S News World Report

linked to bone… read more view wells fargo gap insurance class action lawsuit investigation who’s affected ? did you have an auto loan through wells fargo ? customers who had a car insurance auto insurance rates car insurance comparison auto owners insurance gap insurance free insurance quotes truck insurance automobile insurance Guaranteed asset protection (gap) insurance (also known as gaps) was established in the north american financial industry. gap insurance protects the borrower if the car is totaled by paying the remaining difference between the actual cash value of a vehicle and the balance still owed on the financing. gap coverage is mainly used on new and used small vehicles (cars and trucks) and heavy trucks.

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if Gap Insurance Auto your car is totaled or stolen and you owe more than the car's depreciated value. gap insurance may also be called "loan/lease gap coverage. " this type of coverage is only available if you're the original loanor leaseholder on a new vehicle. I am among the lucky few with a place to stay outside new york city. my privilege is a reminder of a skewed society.

deposit individual retirement accounts youth accounts investment center insurance auto gap insurance roadside assistance blue ribbon home warranty vehicle Gap insurance is a type of auto insurance that car owners can buy to protect themselves against losses that can arise when the amount of compensation received from a. Gap insurance cannot be purchased on the day the car is sold. dealers must wait until the fourth day after handing over the prescribed information. however, there is nothing to stop you buying gap insurance whenever you want, so you are free to initiative a purchase straight away. paying for gap insurance.

cat and zard group term life insurance life insurance iras compare iras roth ira sep ira traditional ira loans auto loans gap coverage new auto loan used auto loan commercial How does gap insurance work? gap insurance covers the gap between what your vehicle is worth and what you are actually on the hook for in regard your vehicle loan after a collision. does gap insurance cover theft? Gap Insurance Auto absolutely. however, typically there is a waiting period (30 days or so) after the claim is filed.

Updated: june 2020. gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's depreciated value. gap insurance may also be called "loan/lease gap coverage. " this type of coverage is only available if you're the original loanor leaseholder on a new vehicle.

Gap insurance (or gap coverage) is a vital car insurance feature for those who need it. but many drivers believe it'll pay for any totaled car, regardless of its age or the amount owed on it. the truth is different. gap insurance exists for drivers with specific needs. If you purchase gap insurance from a car insurance company, it will cost $41 a year, on average, carinsurance. com's rate analysis of major insurers found.. in some cases when you are insuring a new car, you can get gap coverage as an add-on endorsement to your standard policy; check with your insurer to find out if it is offered. you must also have collision and comprehensive coverage on the. Gap insurance is a good idea if you owe more on your car than it's worth, which is usually the case with a loan or a lease. conventional wisdom states that a new car loses a significant percentage.

Belum ada Komentar untuk "Gap Insurance Auto"

Posting Komentar