Grid Trading Forex

The grid trading system is merely a way of trading and is not to be misunderstood as a trading system that offers buy/sell signals. in many cases, a grid based trading system is used in conjunction with other trading methods. the chart below illustrates how this is achieved. in the following chart, we make use of a simple channel trading method. Learn forex trading from best professionals. intelligent grid based trading robot just got better! +205% profit in less than 6 months. In august 2005, the forexgm team was assembled and started building their own grid-trading software, forexgridmaster. the aim was to create the rolls-royce of forex trading systems, the perfect tool for, but not limited to, mathematically-minded traders who required a stable environment to develop consistent, automatic trading strategies. After trading it manually for some time, we decided to bring it to the next level and fully automate it. this is how the fpp grid was born. next generation today, thanks to all of you out there who provided us with extremely useful and valuable feedback we are glad to present the fpp grid 2. 0.

Forexgridmastergrid-trading strategies can be created and further optimized at any time to trade under all forex market conditions, either fully hands-off during open forex market hours, 24/5, or for specific time periods or market conditions, or for semi-manual trading, especially stealth-mode scalping. forexgridmaster's industrial strength code can place and exit trades, faster and more. Odin finds great forex trades using a reliable grid trading strategy. every price movement on your charts has smaller movements inside of it. plotting each movement against a grid reveals predictable patterns. odin takes these patterns and analyzes them for future probability. the end result is highly accurate trades with no indicator lag.

Grid Trading Strategy Explained And Simplified

The no stop, hedged, forex trading grid system is described. there are 3 options on how to learn and use this system. a forex trading grid course can be received free if you are a expert4x club member or can be purchased outright. The forex grid trading strategy is a technique that seeks to make profit on the natural movement of the market by positioning buy stop orders and sell stop orders. this is performed on a predefined market distance (referred as to a leg), with a preset size of take-profit and no stop-loss. The issue with grid trading is it cant be back tested. single trade destiny is based on itself. but when trading grid the destiny of single trade is based on the next executed ones. here the endless combinations comes into play. so any strategy grid trading forex created can not be back tested. only slow/boring forward test is possible. good luck.

The forex double grid strategy forex opportunities.

The Forex Double Grid Strategy Forex Opportunities

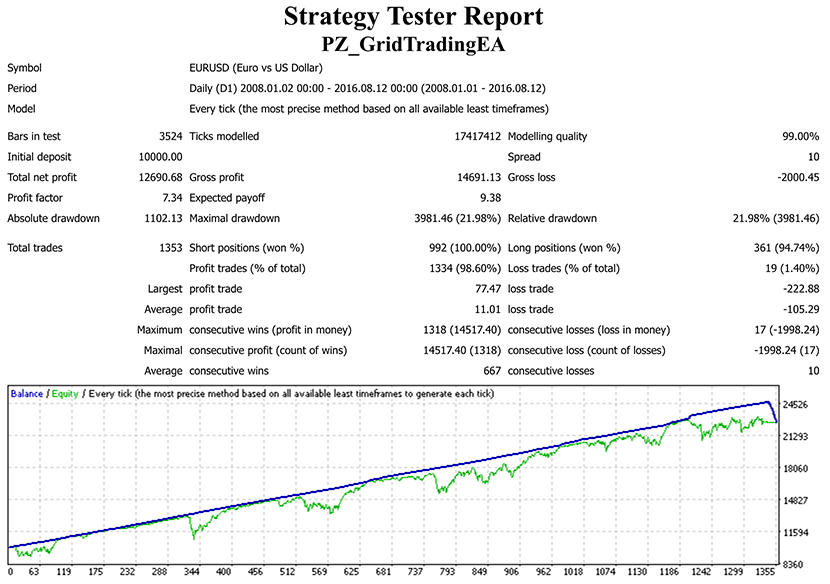

Gridtrading for forex is done with two types of grids, pure and modified. pure grids these function on the assumption that it is the gridded range itself that will hold together and that it is natural for the market to trade sideways 80% of the time and to trend only 20% of the time. Grid ea trading system. for metatrader 4. so we could offer you most stable and safe release with completely new strategy using gridtrading system. ea was tested in various market conditions to prove its stability. because it is the only way to gain profit from always chaotic and unpredictable forex market. it may sound a bit confusing. Endhour for automatic, at what time do you want the ea to end the grid trading. stoptradingafter for automatic, it will stop trading after it opens several grid trading. let say you set it to 5. it will stop trading after the ea closes the 5th grid regardless how many days it takes per grid.

How Do Forex Grids Work Blackwell Global

What Is The Forex Grid Trading Strategy Admiral Markets

Grid trading: a foreign exchange trading technique that seeks to capitalize on normal price volatility in currency markets by placing buy and sell orders at certain regular intervals above and. A hedged grid is a play on market volatility. there are grid trading forex two reasons why it’s appealing to forex traders. the first is that it doesn’t “require” you to have a definitive prediction on the market direction.. the second is that it works well in volatile, ranging markets, where there isn’t a clear trend conditions which are common in the currency markets. Modified grid trading system. unlike the pure grid trading system, the modified grid trading system cares about the market direction prior to sprouting its grid legs in support of it. the system first determines its initial entry from indicators that attempt to gauge market direction and strength.

The only major negative aspect of grid trading is that in a strong trading market, you can incur very large drawdowns, however, when we have ranging conditions the grid trading system performs very well and since the forex market spends 75% in consolidation it’s very much more suitable for the currency market. The forex hedging dual grid strategy can be highly effective in grid trading forex a choppy and ranging market and since it’s a market neutral strategy you don’t need to predict the market direction. forex hedging dual grid strategy explained… there are four steps to trading the grid system:.

Forexgridmaster grid-trading strategies can be created and further optimized at any time to trade under all forex market conditions, either fully hands-off during open forex market hours, 24/5, or for specific time periods or market conditions, or for semi-manual trading, especially stealth-mode scalping. forexgridmaster's industrial strength code can place and exit trades, faster and more. See more videos for forex grid trading. The best news is, you could installation an automated forex grid trading machine that could do away with the ache of manually placing trades. free grid trading strategy pdf system. the remarkable thing approximately a grid trading gadget is that it allows you get a return for your investment even in risky marketplace situations. The design of the forex trading grid depends on the trader's strategy and risk tolerance. nevertheless, most grids generally look quite similar. all of them have a common structure a visual grid in the chart, where the moving price rate comes through the levels and "picks up" the result of preset parameters.

Grid trading definition investopedia.

Belum ada Komentar untuk "Grid Trading Forex"

Posting Komentar